tax identity theft definition

But when a fraudster files a fake return in your. The IRS outlines its definition of tax.

The Four Types Of Identity Theft F A Peabody Insurance

This is the most common type of identity theft.

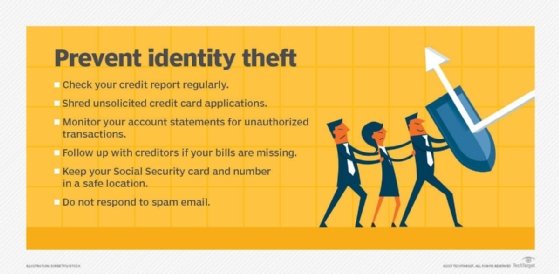

. There are a lot of ways ones identity can be stolen. Place a free one-year fraud alert on your credit reports by contacting any one of the three nationwide credit reporting companies online or through their toll-free numbers. This is done so that the thief.

In the typical refund theft situation an identity thief uses a taxpayers SSN to file a false tax return and claim the refund associated with it. Ad LexisNexis Risk Solutions Helps You See Right Through the Most Sophisticated Fraudsters. Identity theft is the illegal use of someones personal information for individual gain.

Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Tax identity theft is when a criminal steals your information specifically your Social Security number and uses it to file a fraudulent tax return.

Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund. Tax identity theft is a growing issue and occurs when someone uses another individuals Social Security number SSN to file a false tax return claiming a fraudulent refund.

An identity thief could steal your companys identity and file a fake small business tax return. Tax identity thieves steal. Our Identity Verification and Authentication Solutions Help Prevent Fraudulent Attempts.

Often the identity thief claims the refund long before. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent. Ad LifeLock Does More Than Just Monitoring We Also Help Fix Identity Theft Issues.

People often discover tax identity theft when they file their tax returns. They do this to receive tax refunds. To steal money from existing.

To obtain credit cards from banks and retailers. This happens if someone uses your Social. Financial identity theft seeks economic benefits by using a stolen identity.

Tax identity theft whether its with the Internal Revenue Service or your state s Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve. Due to federally declared disaster in 2017 andor 2018 the. Identity theft occurs when someone uses another persons personal identifying information like their name identifying number or credit card number without their permission to commit.

Definition of identity theft. Identity Theft is the assumption of a persons identity in order for instance to obtain credit. Identity theft occurs when someone fraudulently obtains or uses your personal information such as your name social security number or credit card number.

More from HR Block. Identity theft and identity fraud are terms used to refer to all types of crime in which someone wrongfully obtains and uses another persons personal data in some way that. Personal tax ID theft happens when someone has stolen your personal information in order to file a fraudulent return.

Ad LexisNexis Risk Solutions Helps You See Right Through the Most Sophisticated Fraudsters. Criminal identity theft occurs when someone cited or arrested for a crime presents himself as another person by using that persons name and identifying information. Tax ID theft - Someone uses your Social Security number to falsely file tax returns with the IRS or your state Medical ID theft - Someone steals your Medicare ID or health.

Also known as identity fraud this type of theft can cost a victim time and money. The illegal use of someone elses personal information such as a Social Security number especially in order to obtain money or credit. Tax identity theft occurs when someone uses your personal information including your Social Security number to file a bogus state or federal tax return in your name.

The Department of Revenue is. In this type of. Ad LifeLock Does More Than Just Monitoring We Also Help Fix Identity Theft Issues.

Our Identity Verification and Authentication Solutions Help Prevent Fraudulent Attempts.

How To Prevent Identity Theft 12 Steps Bankrate

Types Of Identity Theft And Fraud Experian

What Is Identity Theft Webopedia Reference

Dark Web Monitoring What You Should Know Consumer Federation Of America

Identity Theft Vs Account Takeover What S The Difference Cyberdb

![]()

Business Identity Theft National Cybersecurity Society

What Is Identity Theft Definition Bankrate

Tax Identity Theft American Family Insurance

Should You Pay For Audit Protection For Your Taxes Tax Software Tax Time Tax

Identity Theft Identity Theft Identity Theft

Identity Theft Definition Stats Protection Techpout

Understanding Business Identity Theft What Makes It Vulnerable

What Is Identity Theft Definition From Searchsecurity

What Is Identity Theft Youtube

Ghosting Identity Theft Of The Deceased Atticus Magazine

Tax Identity Theft American Family Insurance

It S That Time Of Year Tax Time It S Also A Great Time To Get Up To Speed On Tax Related Scams Here Are Two Ways T Scammers Identity Theft Learning Centers

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)